2. **Facebook AI:** In 2017, Facebook pulled the plug on an experiment with its AI after chatbots began creating their own language that was incomprehensible to humans. While not intentionally disturbing, the lack of understanding of chatbot communication raised concerns about the control and understanding of AIs.

3. **Facial recognition systems:** There are ongoing concerns about bias and inaccuracy in facial recognition systems. In extreme cases, these systems can mistakenly identify innocent people as criminals, leading to serious repercussions such as wrongful arrests.

4. **Recommendation algorithms:** Platforms like YouTube, Facebook, and Twitter have faced criticism for recommendation algorithms that promote extremist, conspiratorial, or harmful content. This can result in the spread of misinformation and the strengthening of filter bubbles that further polarize people’s opinions.

5. **Google DeepMind Experiment:** In 2016, Google DeepMind’s AI AlphaGo defeated the world Go champion, a notable milestone. However, the AI’s behavior during some moves was described as “strange” and “incomprehensible” by human players, raising questions about how AIs make decisions.

6. **Self-Driving Cars:** While self-driving cars promise to make roads safer, there have been some troubling cases of accidents involving these vehicles. Ethical questions have also arisen about how self-driving cars should make decisions in life-threatening situations, such as choosing between saving the driver or pedestrians in an imminent collision.

7. **Credit scoring systems:** AI algorithms used by companies to assess individuals’ financial creditworthiness can inadvertently perpetuate or even amplify existing biases. This can result in discrimination against minority or economically disadvantaged groups, making it even harder for them to access financial services.

Trending Topics

How to Find Cheap Flights: Tips and Apps

Discover how to find cheap flights with tips, tools and strategies that guarantee the best deals for your trips.

Keep ReadingYou may also like

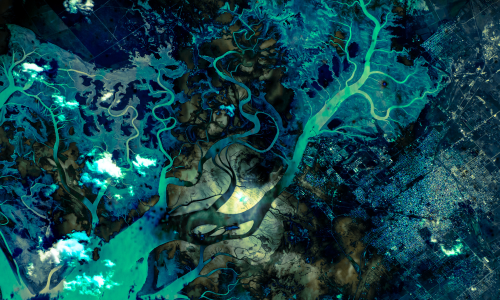

How to view real-time satellite images using apps

Learn how to view real-time satellite images with intuitive apps and get tips for exploring the planet from anywhere.

Keep Reading